Why High-Income Households and Millennials are Fueling Retail Resiliency in 2025

As a marketer with over two decades in the trenches, I’ve learned to be skeptical of broad economic narratives. My experience tells me that aggregate data, while useful, can often mask the most important truths. It’s a bit like looking at a national weather map and concluding that everyone has the same forecast—it’s never that simple. This is why I find the current state of the U.S. consumer economy so fascinating. On the surface, things appear resilient. Yet, when you pull back the curtain, it's a completely different story.

Recent economic analyses, this high-earning demographic is disproportionately responsible for a large share of total consumer spending. Retail spending patterns among these households have also shifted, with some increasing their spending while others have become more value-conscious.

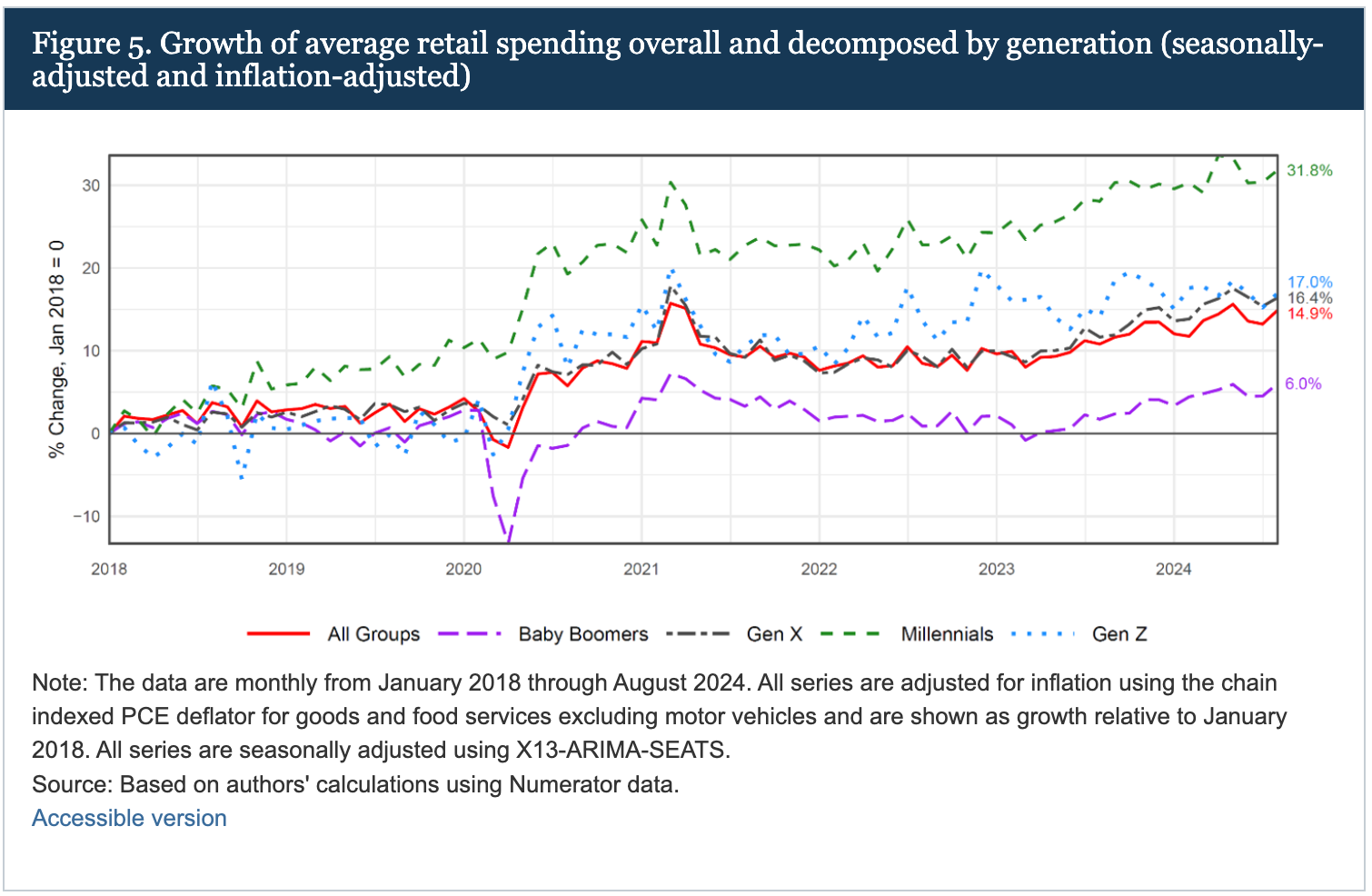

My observation is that the economy is taking an interesting and strategic turn. I’m particularly struck by the fact that over half of the U.S. retail spend is now accounted for by households with an annual income above $200,000. This isn't just a trend; it's a fundamental shift in who holds the purchasing power. Simultaneously, I find it intriguing that Millennials are the ones driving the most significant growth in spending, while Gen X and Gen Z’s spending growth has not kept pace. This dynamic, coupled with the long-standing correlation between higher levels of education, higher income, and greater spending, paints a clear picture.

If your business relies on a lower-income customer base, you are likely facing an increasingly tough road. The middle class is shrinking, and the economic landscape is diverging in a way that demands a more nuanced, data-driven approach from all of us.

This is a scenario where the strategic questions matter more than the simple answers. My purpose today is to guide you through this divergence and show you how to navigate it, grounded in the data I’ve been analyzing.

From Aggregate Data to Strategic Segmentation

For months, we’ve heard the story of the “resilient consumer.” Monthly retail sales reports, like those from the Census Bureau, suggest that consumer demand is holding strong. But these top-down metrics don't tell us which consumers are driving that resilience. It’s a crucial distinction that can mean the difference between strategic growth and marketing inefficiency.

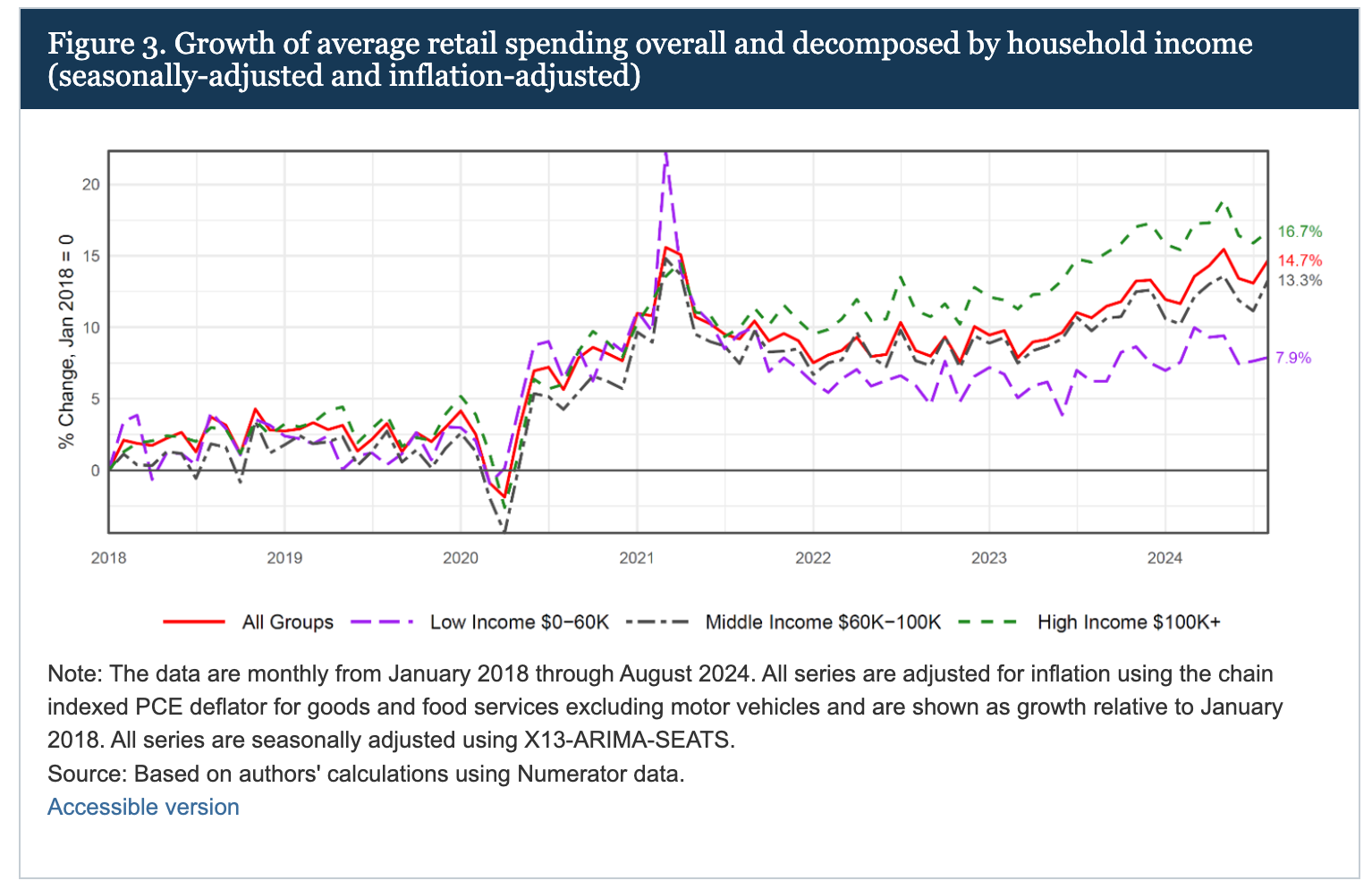

A closer look at detailed micro-datasets, which track household-level spending, reveals a stark reality: consumer resilience has been overwhelmingly driven by middle- and high-income households. High-income households, defined as those with an annual income of $100,000 or more, have increased their real average spending by 16.7% since January 2018. Middle-income households ($60K-$100K) have also shown strong growth at 13.3% over the same period. In sharp contrast, low-income households ($0-$60K) reduced their real average spending between mid-2021 and mid-2023, only recently recovering to their prior levels.

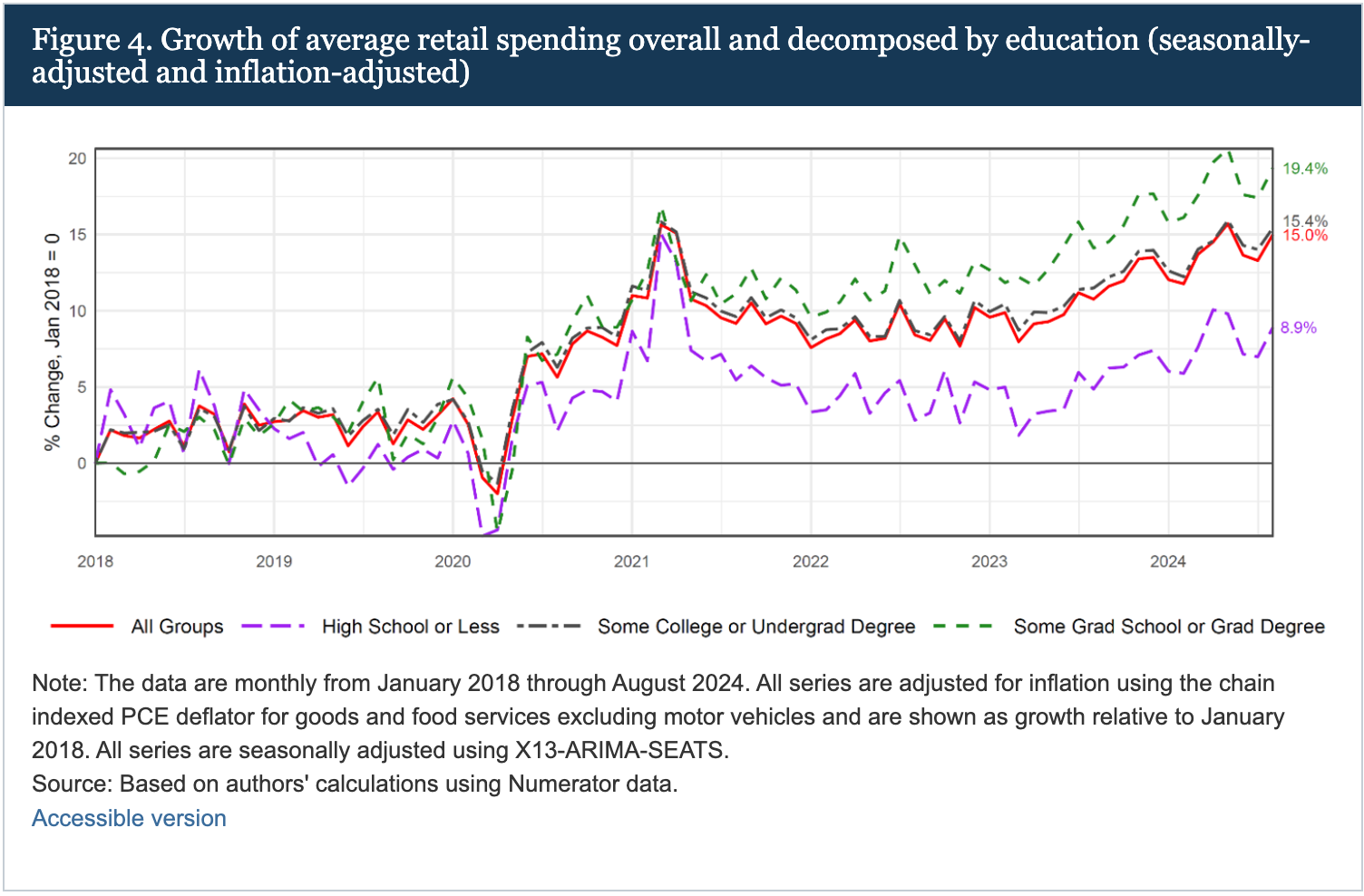

This divergence isn't limited to income brackets. It extends to education and even housing status. My analysis shows that spending patterns mirror education levels, with households led by someone with a graduate degree showing sustained resilience while those with a high school education or less experienced a notable pullback in spending. Additionally, those who were able to lock in low, fixed-rate mortgages before 2022 have more disposable income and have been able to sustain higher retail spending. Meanwhile, recent homeowners who face higher monthly payments have actually seen their real retail spending decline since mid-2022.

The lesson here is clear: the broad narrative of “the consumer” is no longer a viable basis for strategic decision-making. We must move beyond the macro-level data and embrace a more granular, bottom-up approach to understand the true drivers of demand.

The Generational Pivot: Why Millennials Are Leading the Charge

One of the most compelling pieces of data I've come across points to a significant generational shift in spending power. When we decompose average household spending by generation, the results are illuminating. Since 2018, Millennials have increased their real retail spending the most, while Boomers have increased theirs the least.

This isn't an accident; it's a demographic story playing out in real-time. Millennials are now aging into their peak earning and spending years. They’re establishing households, raising families, and increasingly moving into senior professional roles. Their economic momentum is a direct result of a strong labor market that has allowed them to increase their earnings.

Conversely, Boomers are increasingly on fixed incomes or have retired, leading to more cautious spending habits. It’s a simple, yet profound, economic reality. Marketers who are still targeting "the family" as a monolithic concept without considering the generational nuances are missing the boat. The strategic focus must shift to understanding the unique financial drivers and spending behaviors of the Millennial cohort.

The Disconnect Between Sentiment and Spend

This is where things get truly interesting. Even with strong spending numbers among key demographics, consumer sentiment has remained unusually low. My research shows a significant disconnect: consumers say they feel worse, but their actual, verified purchasing data shows that they are buying more—not just spending more—than they did in 2019.

As a marketer, this paradox is a critical one to understand. It tells me that relying on sentiment surveys alone to predict future consumer behavior is a weak strategy. The data from these surveys indicates that negative sentiment is less about a lack of income and more about the perceived effort required to maintain their lifestyle. People feel worse because they perceive that prices have risen faster than their incomes, even when their real spending has increased.

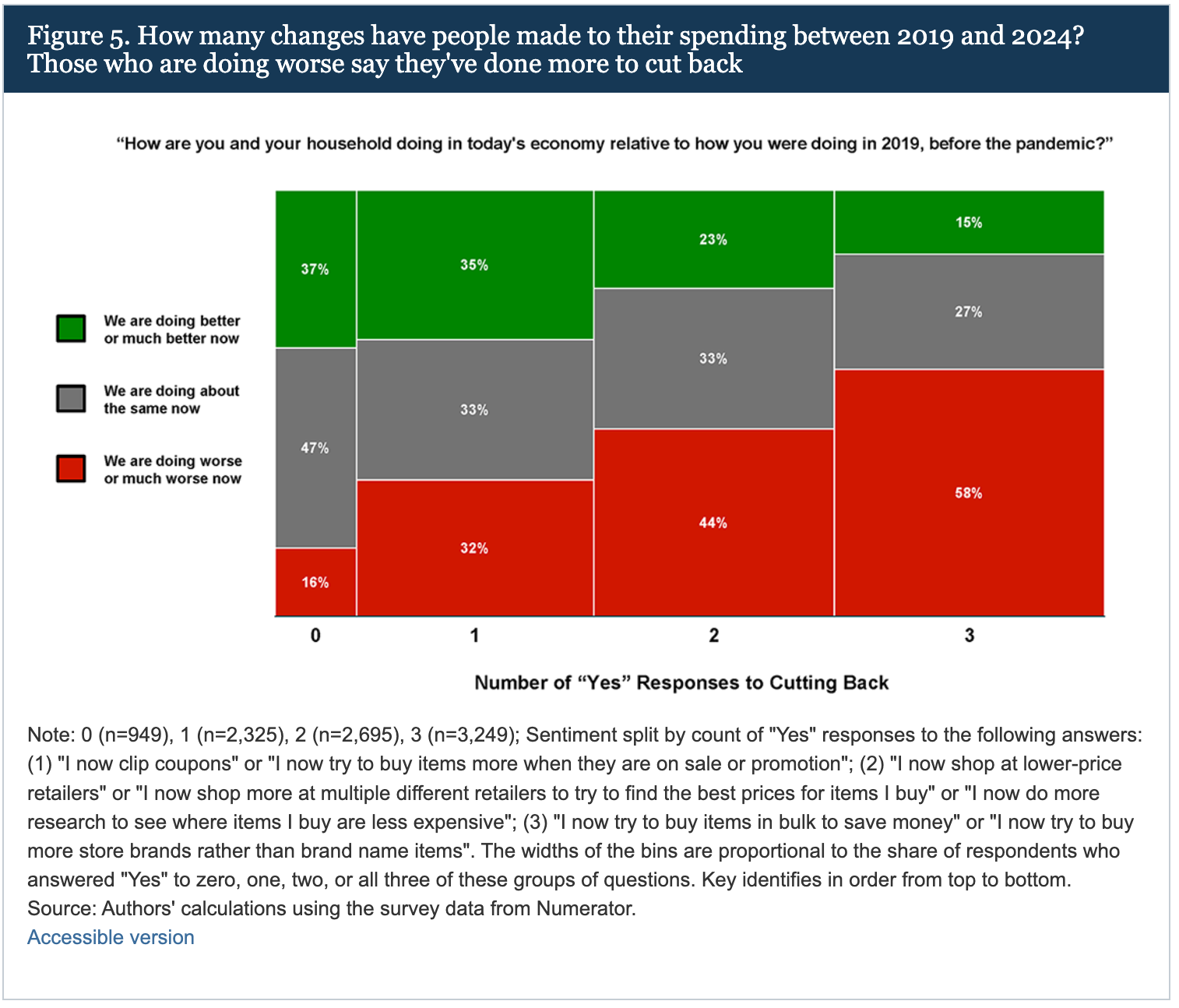

In fact, the more changes a household made to cut back—things like clipping coupons, shopping at lower-priced retailers, or buying store brands—the worse they felt about their economic situation. Similarly, those who had to work more hours or take on additional jobs to earn more money were more likely to report feeling worse.

This is a powerful lesson for us. The challenge isn't always a lack of demand; it’s a feeling of effort and a perception of a loss of control. The brands that can deliver value without making the consumer feel like they are working harder for it are the ones that will win in this environment.

The Strategic Path Forward

So, what does all of this mean for you?

First, you must abandon the idea of a single, uniform consumer. The data is unequivocal: the consumer economy is bifurcated. You cannot effectively market to high-income households and low-income households with the same message, through the same channels, or with the same product mix. Your targeting, segmentation, and value proposition must be tailored to these distinct segments.

Second, you must recognize that the "resilient consumer" is not an abstract concept but a precise set of demographics. In this environment, the resilient consumer is likely a high-income Millennial with a higher education who owns their home and has a low, fixed-rate mortgage. This is a generalization, of course, but it points to the type of micro-level targeting that will yield the highest ROAS. The strategic imperative is to identify and double down on the segments that have the verifiable purchasing power to sustain demand.

Finally, while it’s important to acknowledge how consumers feel, you must ground your strategy in what they do. People’s spending habits reveal more than their stated sentiment. Use tools and data that provide a bottom-up view of consumer spending to get a clearer picture of your target market's true economic health.

This isn't a time for business as usual. It's a time for data-driven precision, strategic nuance, and a deep understanding of the human and economic factors driving our new reality.

If you’re ready to move beyond the headlines and get a truly granular view of the consumer landscape, I invite you to subscribe to the ZoomMetrix newsletter. My team and I are dedicated to providing the in-depth, actionable insights you need to make better strategic decisions.

ZoomMetrix Newsletter

Join the newsletter to receive the latest updates in your inbox.