Nike’s DTC Journey: Ambition, Challenges, and Realignment

Explore Nike's DTC evolution, recent struggles, and rebalancing strategy. Key lessons for marketers and businesses navigating the direct-to-consumer space.

Growing up in the '80s and '90s, Nike was at the heart of my youth, a brand that defined the aspirations of so many across America. From their iconic "Just Do It" campaigns to the dominance of their sneakers on playgrounds and courts, Nike felt like more than just a company—it was a symbol of ambition and innovation. As a shareholder today, it’s disheartening to witness the struggles they’ve faced in recent years. What happened to this once unstoppable brand? Let’s take a closer look at their direct-to-consumer (DTC) strategy, the challenges they’ve encountered, and where they might be headed next.

Nike has long been a household name in athletic apparel, celebrated for its innovative products and razor-sharp marketing campaigns. Yet, in recent years, its direct-to-consumer (DTC) strategy has become a critical part of the conversation around its business approach. While DTC promises greater profits and stronger consumer relationships, Nike’s ambitious efforts have been met with both highs and hurdles, leading to renewed strategies.

Let's go through Nike’s DTC story, from its early steps in online sales, its strategic evolution, recent challenges, and how it is maneuvering a future full of recalibration and innovation—all with valuable lessons for modern marketers and businesses.

Nike’s Initial Foray into DTC Online Sales

Nike’s venture into direct-to-consumer channels wasn’t an overnight decision. It began in the late 1990s, when the rise of the internet offered the promise of reaching consumers directly rather than relying solely on wholesale partners. For Nike, this was seen as an opportunity to strengthen its brand presence, control customer touchpoints, gather critical consumer data, and increase profit margins by bypassing intermediaries.

Cautious Beginnings

Nike officially launched its website, Nike.com, in the late 1990s with the debut of the "Nike Alpha Project," a limited online offering that primarily served as a test case for e-commerce. By making this an exclusive, three-month-only experiment in the U.S., Nike demonstrated its careful, calculated approach to entering unfamiliar territory.

However, transitioning from a wholesale-heavy model to e-commerce presented multiple challenges. From building adequate website infrastructure to managing digital inventory and ensuring secure online transactions, Nike faced the complexities of establishing a feasible online strategy. Early studies, such as the 2000 Stanford case study, underscored that while Nike's online ambition was evident, executing and scaling a profitable DTC model was no easy task.

The Wholesale Conundrum

Nike’s decision to move into direct sales also sparked concerns among wholesale partners. Many feared that Nike’s direct online presence would compete against their own sales efforts and potentially undercut prices. To mitigate these tensions, Nike initially committed to full retail prices for online purchases, with added shipping costs to avoid underpricing its offline partners.

Strategic Evolution Towards Prioritizing DTC

Despite the early challenges, Nike began prioritizing its DTC efforts over the next two decades, through significant innovation and marked strategy shifts.

Balancing Wholesale and Control

To assert more control over branding and customer experience, Nike started reducing its wholesale partnerships, choosing to work only with aligned retailers. By making it more challenging for wholesale partners to meet requirements, and ultimately ending its partnership with Amazon in 2019, Nike set its sights on cultivating premium, first-party relationships with customers.

Innovative Initiatives

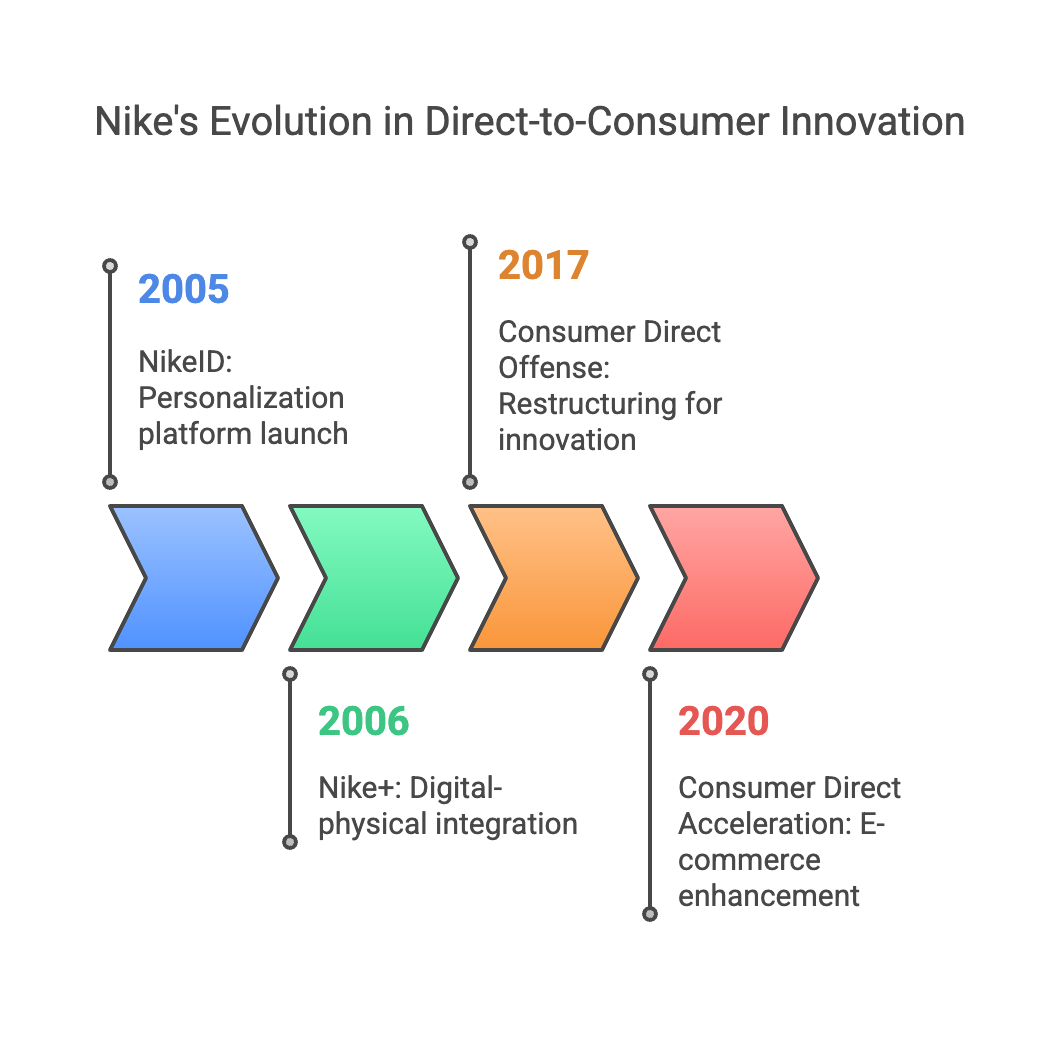

Nike introduced several innovations to bolster its DTC strategy:

- NikeID (2005): A personalization platform for customers to customize products online, fostering deeper engagement while making purchases more meaningful.

- Nike+ (2006): Integration between physical activity and digital technology, epitomizing Nike’s unique ability to blur fitness and e-commerce lines.

- Consumer Direct Offense (2017): This company-wide restructuring focused on speeding up innovation and building one-to-one digital relationships through proprietary platforms.

- Consumer Direct Acceleration (2020): A further evolution, this initiative embraced a headless commerce platform, enhanced fulfillment, and capitalized on the e-commerce boom during the COVID-19 pandemic.

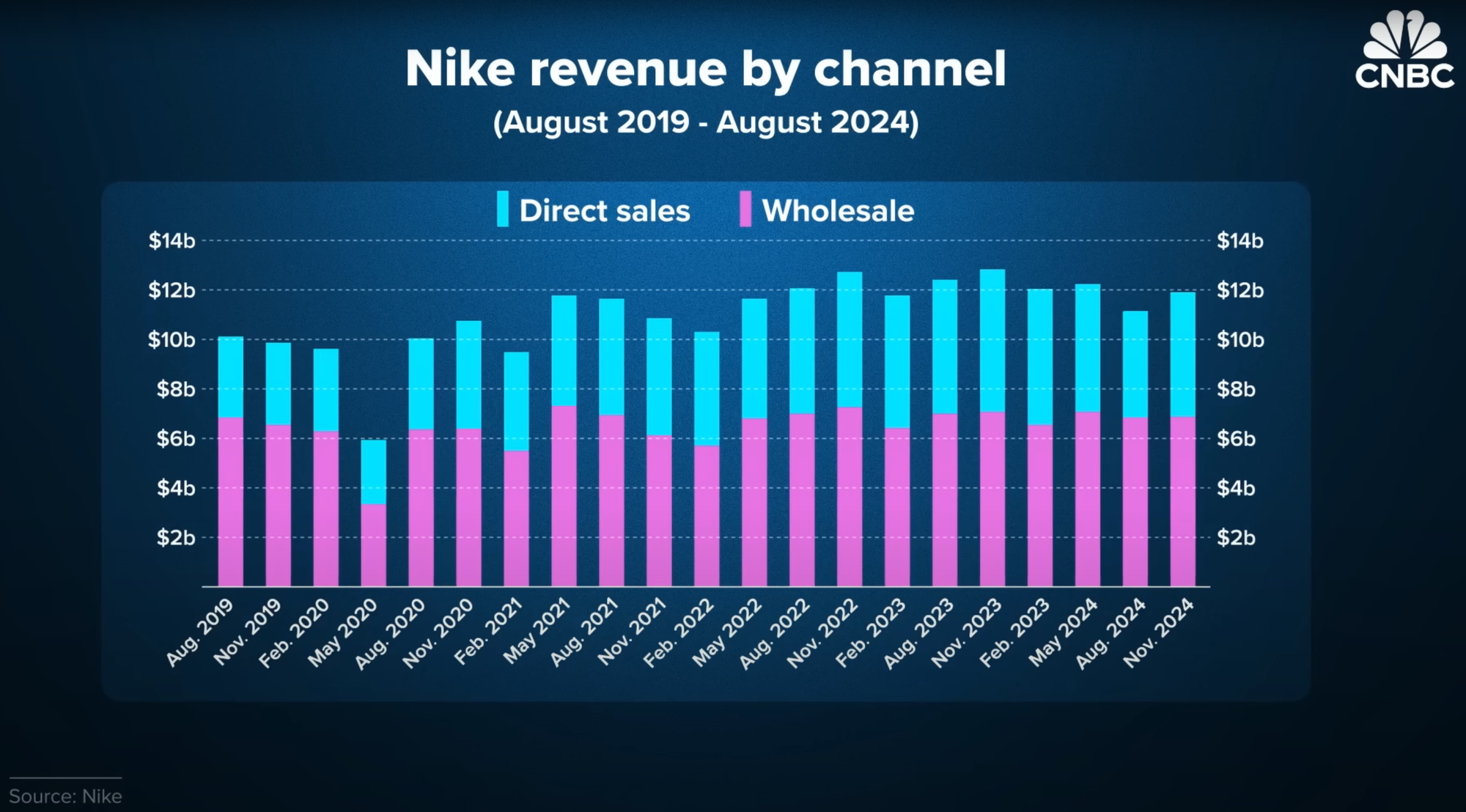

By fiscal year 2021, over 40% of Nike’s revenue came from DTC, with digital channels representing the fastest-growing segment.

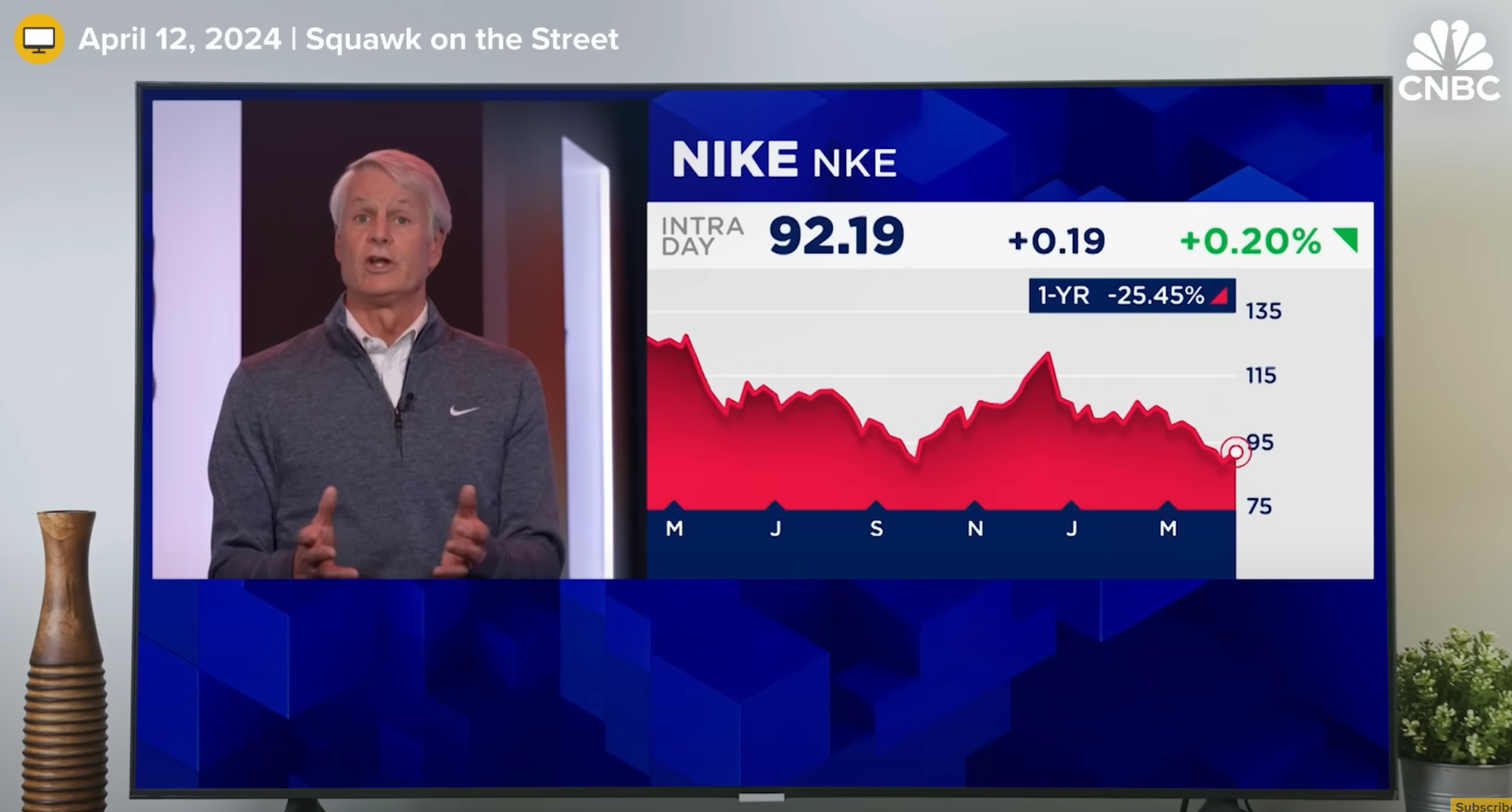

Recent Struggles and Decline in Digital Sales

While the DTC push yielded significant initial success, recent years have seen Nike facing a challenging reality. The fiscal year 2024 marked the first decline in Nike Brand digital sales since 2015, with consecutive quarterly drops exceeding 20% in fiscal year 2025. This trend has broad implications for Nike’s overall revenue and has raised questions about the sustainability of its DTC dominance.

What Went Wrong?

Several factors contributed to Nike’s digital struggles:

- Weaker Product Pipeline: A lack of exciting new products led to reduced consumer engagement and traffic.

- Too Promotional: Nike leaned heavily into discounts, which diluted its premium brand positioning and hurt profitability.

- Reduced Marketing Investment: A shift in marketing away from broad brand campaigns resulted in diminished overall demand creation.

- Post-Pandemic Behavior Shift: Many consumers migrated back to physical retail stores, while Nike’s over-focus on DTC left less shelf space with wholesale retailers.

- Inventory Challenges: Excess products from post-pandemic supply chain resolutions led to an overstock problem, contributing to widespread discounting that cheapened the brand.

Compounding these challenges have been external factors, including rising inflation, reduced consumer spending in key international markets like China, and competitor advancements. Brands like Hoka and On are gaining ground, particularly within performance running, a previously untouchable category for Nike.

Nike’s Response and Future Strategies

True to its innovative legacy, Nike has already begun recalibrating and responding to its recent challenges. By broadening its playbook, it is working to stabilize its position and reignite growth.

Key Adjustments

- Shifting Focus to Full-Price Sales: Nike has reduced promotional activity and is reorienting Nike Digital to emphasize full-price models.

- Rebuilding Wholesale Partnerships: Recognizing the value of physical retail, Nike is reinvesting in key wholesale partners to reclaim market reach and shopper visibility.

- Clearing Excess Inventory: New CEO Elliott Hill is taking decisive action to resolve inventory challenges, using discounts to quickly clear products and reset supply chains.

Future-Forward Investments

To cement its future, Nike plans to double down on:

- Sports Marketing: Re-centering its brand around athletes and athletic performance.

- Consumer-Centric Innovation: Creating groundbreaking products to reignite excitement, especially in areas like running and fitness.

- Bold Brand Campaigns: Leveraging stronger, high-impact marketing efforts to reclaim cultural relevance.

Lessons from Competitors

Nike’s DTC story isn’t unique—other major brands have followed similar paths, each offering critical insights:

- Adidas: Their ambitious DTC expansion faced repeated disruptions, highlighting the complexities of scaling digital infrastructure.

- Under Armour: A reduction in promotions led to falling e-commerce sales, demonstrating the importance of striking the right balance between pricing and brand equity.

What Marketers and Businesses Can Learn

Nike’s DTC shift reveals both the promises and limitations of going direct. Here are some key takeaways:

- The Limits of DTC Alone: While DTC eliminates intermediaries, it doesn’t necessarily eliminate costs, including logistics, customer service, and fulfillment.

- The Need for Balance: Businesses should maintain omnichannel strategies, leveraging both wholesale and direct-to-consumer channels to maximize market presence.

- The Importance of Innovation: A robust pipeline of fresh, exciting products must anchor any sales strategy to attract and retain customers.

- Retail Still Matters: Even in a digital age, physical retail remains a critical touchpoint for building brand loyalty and accessing new markets.

- Be Adaptable: Success is about striking the right balance between maintaining control and being flexible to consumer and market dynamics.

Rediscovering the “Athlete” in Nike

Nike’s DTC ambitions showcased its ability to lead—and learn. While challenges have delayed digital momentum, its willingness to adapt signals a strong future trajectory. Businesses watching from the sidelines should glean a clear takeaway: Success is about striking the right balance—between ambition and strategy, control and partnership, innovation and customer engagement.

Nike’s brand still boasts global recognition, wide-reaching influence, and a profound connection to the world of sport. If history is any indicator, Nike’s next act will be as game-changing as the “Just Do It” ethos itself.

What do you think? Will Nike’s DTC strategy pay off in the long run or are they facing too many challenges to truly succeed? How do you see the direct-to-consumer trend shaping the retail landscape in the future?

ZoomMetrix Newsletter

Join the newsletter to receive the latest updates in your inbox.